Read

the text and DO THE EXERCISE (Soon!) to

check your understanding level.

TIPS

»

Now it is not important to know the exact meaning of the words,

only to understand the sentences. For unknown words you can

use the glossary or the "double-click" dictionary,

but first always try to find out the meaning of a word from

its context.

»

Download

and print the glossary or write the words in

your dictionary.

»

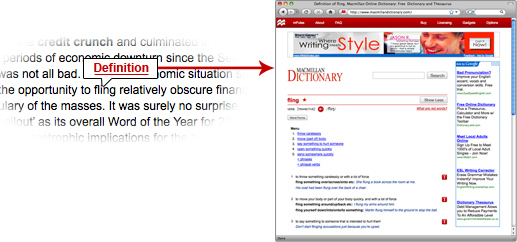

To

look up a word, double click on it or mark more than one word

with the cursor, then click on "Definition", and in

the opening window choose the appropriate word (for pronunciation

click on the  icon).

icon).

»

Check the level of your understanding by doing this exercise:

Bully

for "bully" Orbán's decision to stand up to the

IMF and EU brutes (Adam LeBor

Extracts

for learning English, you can find the article here:

Politics.hu

July 26, 2010

http://www.politics.hu/20100726/bully-for-bully-orbans-decision-to-stand-up-to-the-imf-and-eu-brutes

The original article is only available to subscribers

of the Times here:

The Times July 26, 2010

http://www.thetimes.co.uk/tto/opinion/article2658958.e

The howls

of outrage are echoing from Brussels to Washington DC. Like

the simian slaves in Planet of the Apes, Hungary has uttered

the forbidden word: No.

Viktor Orbán, the Prime Minister, has rebuffed the demands

of the IMF and the EU for more budget cuts and austerity measures.

The moneycrats went home muttering about collapsing currencies

and fiscal irresponsibility. To which Budapest's glorious

answer was: God speed. The forint, Hungary's currency, slid,

recovered and slid again but the country is holding firm.

Instead of cutting services and welfare, the Government will

go for growth by slashing taxes, whitening the economy and

simplifying Hungary's byzantine business environment.

Of course, after the 2008 20 billion EU bail-out package,

the EU and IMF have a right to negotiate over Hungary's financial

plans. And after the IMF-induced privatizations of the early

1990s turned much of this region into an economic wasteland,

Hungary has a right to stick to its guns.

But there is a wider issue at stake here: national sovereignty,

especially of smaller nations. In today's globalized world,

and a streamlined Europe where Brussels and Strasbourg engage

in an unprecedented appropriation of political and legal power

by stealth, national sovereignty has somehow become a dirty

word. Our destinies may be increasingly shaped by globalised

financers and multinational institutions, but I don't remember

anyone voting for this process, or even being given the option.

Ironically, these supranational bodies use the same tactics

as the Communists in postwar Europe - stealthily slicing away

independence and sovereignty until nobody notices that it's

all gone.

But now somebody has. Admittedly, Mr. Orbán, Hungary's pugnacious

premier, seems an unlikely people's tribune. Since his centre-right

Fidesz party won a two-thirds majority this year, his government

has rammed a series of bills through parliament that, critics

say, have packed formerly independent institutions with party

placemen and threaten the checks and balances of democracy.

Opposition politicians say that independence of the media,

the constitutional court and the state audit agency are all

under threat, although few doubt that a shake-up was needed

after eight year of sloth and corruption under the Socialists.

The joke now in Budapest is that democracy has been replaced

by a "Viktatorship." Yet perhaps it takes a Viktator

to stand up to the IMF and the EU.

Not content with telling the financiers where to go, parliament

has just passed a stringent tax on the banks, causing fury

and fear among Europe's financiers: fury that Hungarian banks

will have to pay a levy of 0.5 per cent of bank assets as

they stood at the end of 2009, and fear that this could set

a dreadful precedent, with Hungary's neighbors quickly following

suit. Let's hope so.

The bank tax is well deserved. A good part of Hungary's economic

travails can be blamed on the bankers. An incredible 70% of

all domestic and business lending is denominated in foreign

currency, much of it in Swiss francs. During the boom years

the bankers extended easy and cheap credit, in exotic currencies,

to virtually anyone who asked, even though the borrowers were

paid in forints. Consumers were hustled into credit packages

with risks they barely understood, but which were, however

the markets behaved, guaranteed to bring hefty profits for

the banks. Mortgages that cost 100,000 EU are now debts of

perhaps 140,000 EU, with little if any hope of ever being

repaid.

So hooray for Hungary, standing up to the IMF and EU bullies.

In 1956, Hungarians rose against Soviet tyranny, hoping to

trigger a chain reaction. That didn't happen, but perhaps

Hungary's stand against capitalist despots will spark one

this time.

|

STEP

1 »

STEP

2 »

STEP

1 »

STEP

2 »