Read

the text and DO

THE EXERCISE to check your understanding level.

TIPS

»

Now it is not important to know the exact meaning of the words,

only to understand the sentences. For unknown words you can

use the glossary or the "double-click" dictionary,

but first always try to find out the meaning of a word from

its context.

»

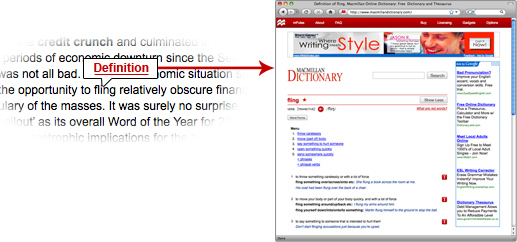

To

look up a word, double click on it or mark more than one word

with the cursor, then click on "Definition", and in

the opening window choose the appropriate word (for pronunciation

click on the  icon).

icon).

»

Check the level of your understanding by doing this exercise:

http://www.englishexercises.org/makeagame/viewgame.asp?id=4577

Fund

to Hungary: drop dead (maybe)

Extracts

for learning English, you can find the original article here:

The Economist 18th July 2010

http://www.economist.com/blogs/easternapproaches

MONDAY

may be a good time to pick up Hungarian assets on the cheap.

The IMF and the EU walked away from negotiations with the Hungarian

government on Saturday after the latter refused to give in to

the international organisations' demands for more clarity on

the country's plans for tax and spending. It seems safe to assume

the Hungarian forint will start the week with a sharp lurch

downwards.

/.../

All

parties said talks would resume, but the uncertainty is the

last thing Hungary, or any other emerging market needs to

see right now.

The

EU and the IMF wanted to see a commitment to spending cuts,

reforms to ill-run state enterprises like the railways, and

a clearer picture of how the government would be raising revenues.

One

bone of contention was the government's planned windfall tax

on banks and other financial institutions - from which it

is hoping to raise some Ft200bn (EU700m) a year over the next

two years. Assuming it works - and Italy's Unicredit or Austria's

Erste have plenty of other places to put their money - the

international lenders wondered whether a windfall tax was

a good basis for sound fiscal policy.

The

IMF called for 'durable, non-distortive measures,'

'Difficult decisions will be needed not only on the revenue

side - where the high financial sector levy, which is likely

to adversely affect lending and growth, is planned to be temporary

- but also on the spending side.'

/.../

As

Nomura said in a note, the failure to issue a polite communique

is:

'...a

very rare event, countries usually go out of their way to

satisfy these missions. The IMF has said indeed that they

didn't even get to discuss the extension as they didn't reach

agreement on the current SBA.'

This

was not a government dead set on pleasing its guests. Local

media reported during the negotiations that the IMF was not

pleased that Viktor Orban, the prime minister (pictured),

chose to be in South Africa watching the World Cup final when

the delegations arrived. Nor can it have helped that Sandor

Csanyi, head of OTP, Hungary's largest bank, was there at

the same time. It was also unfortunate that an amendment to

the windfall tax law was introduced while the IMF was in town,

one which would exclude seven insurance companies set up since

2007 from the tax, including one on whose board sits a key

economics adviser to Mr Orban, along with several politicians

from his Fidesz party.

One

explanation for this intransigence is that Fidesz is under

pressure. The party won a landslide election victory just

three months ago with promises to 'save the healthcare system',

spur economic growth and, above all, cut taxes. Last year's

fiscal consolidation came at great social cost, and the outgoing

government paid a heavy political price for it. The banking

tax is an attempt to square the circle.

Local

elections are due in October, and yapping at Fidesz's heels

is Jobbik, a far-right nationalist party even less obeisant

to the etiquette of international finance than Fidesz.

This

was their response to the debacle:

'We

can guess at the choreography that will follow from Monday:

politicians, analysts and journalists serving the global financial

powers will lay into the government for not giving into foreign

pressure. Jobbik will not be part of this... The discussions

with the IMF and the EU are a key front in the fight for economic

independence,' they wrote, evoking the spirit of the

'fight for independence' that followed the 1848 revolution

against the Hapsburgs in Vienna.

From

inside the country, the government feels pressure to take

a bolder, even reckless, approach. Mr Orban himself talked

about 'debt rescheduling' in remarks to businessmen

two years ago. Austerity has its limits. So does lenders'

patience.

|

STEP

1 »

STEP

2 »

STEP

3 (Coming

soon!)

STEP

1 »

STEP

2 »

STEP

3 (Coming

soon!)